Built Broke: 6 Habits That Are Keeping Nonprofits Broke (Part 1) [Built to Break Series]

Nonprofits don’t usually die because their missions stop mattering.

They die because the money dries up.

And too often, it’s not donors who fail them — it’s leaders clinging to fragile habits that set the stage for collapse.

Here are the 3 of 6 traps that keep nonprofits financially weak, with hard truths, real examples, and business parallels, and ways to overcome them:

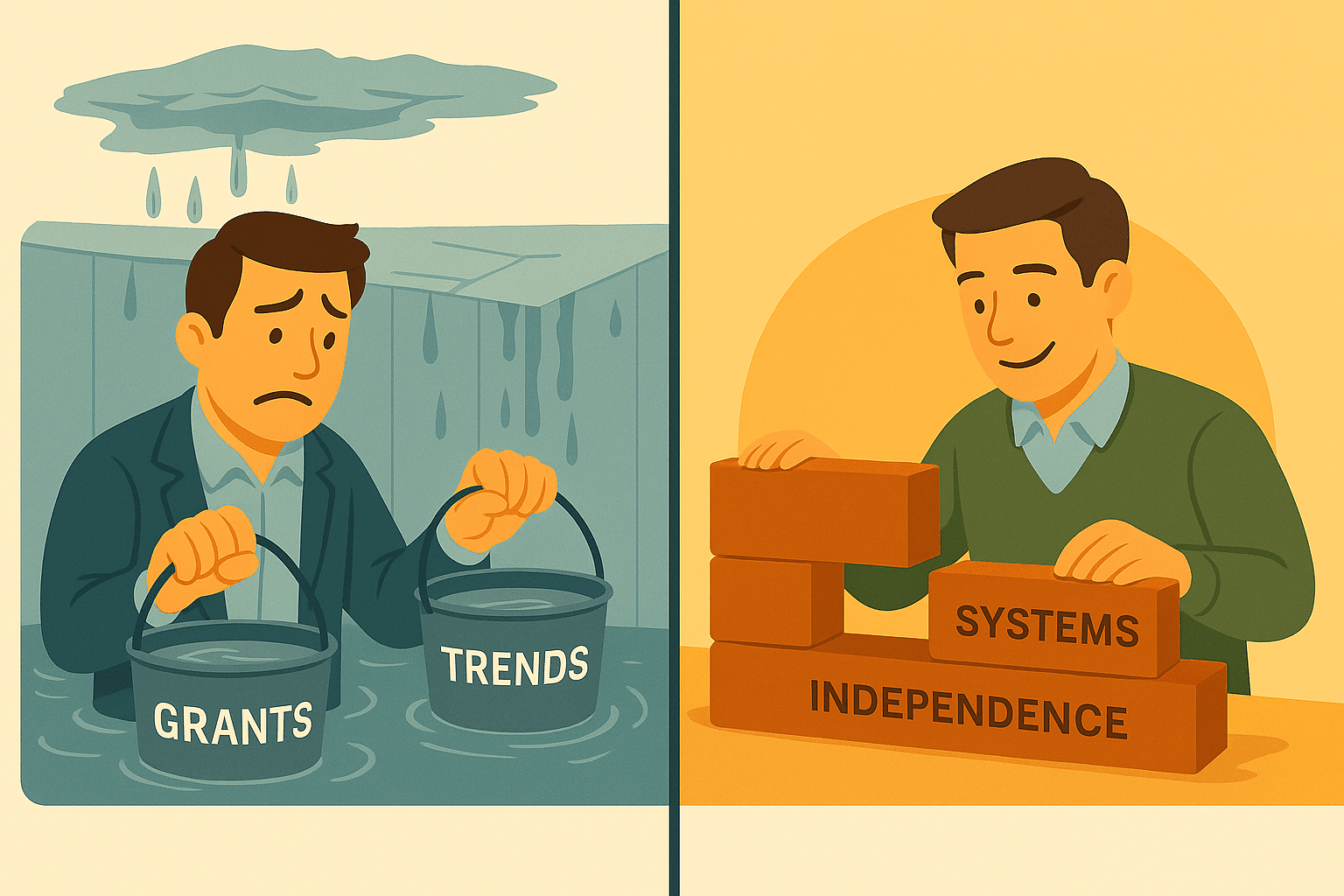

1. Overdependence on Government Grants

Big grants can feel like a lifesaver: payroll is covered, programs are funded, leaders finally exhale. But here’s the truth — that money isn’t yours. It belongs to politicians who can shift priorities as fast as the news cycle. A program fully funded today can be gutted tomorrow. Smaller grants may come as lump sums, but the big ones nonprofits chase are often paid out in installments — which means they can be paused, reduced, or cut midstream.

Real Example: In 2025, U.S. federal funding for DEI initiatives was cut nationwide. Whether you agree or not is irrelevant — the reality is entire funding streams disappeared overnight. Some organizations had used that money to hire 10–25 full-time staff and launch big marketing campaigns without investing in infrastructure. When the funding dried up, their budgets couldn’t sustain those positions, programs shrank, and missions stalled — sometimes forcing layoffs of entire teams before the work was truly complete.

The Business Parallel: This is like a company depending on one “whale” client for 80% of revenue. Even if they don’t leave for a competitor, they might fold — maybe the founder retires, or AI wipes out their industry. How fast could an organization replace that revenue without major disruption?

Wake-Up Solution: Stop treating grants like a magic pill. They’re volatile. Use them as accelerators — fuel to build independence, not shackles that trap you in programs needing constant refills of outside money. Allocate funds to infrastructure and durable revenue streams instead of dumping it all into programming. Grants should be jet fuel, not your oxygen tank. Are you using grant money to build independence, or just buying time until the next grant?

2. Fragile Corporate Sponsorships

Nonprofits often present sponsorships as “solid partnerships” with companies, hyped up by logo placements and press releases. In reality, most are agreements between individuals inside each entity. That makes them fragile. When one executive leaves — or when your own staff contact moves on — the so-called partnership often evaporates. What looked like organizational commitment was really personal goodwill, sometimes flavored with favoritism.

Real Example: Across the sector, sponsorships have followed executives out the door instead of staying with the company. The nonprofit thought they had the corporation. What they really had was a person.

The Business Parallel: It’s like a sales rep landing a big account with a handshake but never securing a formal contract with renewal terms. As soon as their contact at the client company leaves, the deal disappears. People may do business with people they know, like, and trust — but lasting partnerships happen when companies know, like, and trust other companies. Do sponsorships live in the company — or just in someone’s contact list?

Wake-Up Solution: Don’t bank on personalities. Institutionalize value. Build multiple ties across the company, design programs that deliver mutual benefit, and link your mission to their long-term business interests. Let individuals be champions while getting their individual benefit, and make sure the relationship is also company-to-organization. Otherwise, you’re always one resignation away from collapse. If your sponsor contact or internal lead left tomorrow, would the deal survive?

Another Danger: How many of your sponsors are tied to just one person — or worse, only to your CEO or Executive Director?

3. Chasing Political and Social Trends

When your cause trends, money floods in. Media buzz, celebrity endorsements, urgency — donations spike. But the wave always recedes. Too many nonprofits treat a temporary surge as permanent growth, staffing up and expanding as if the faucet will never shut off. Then the spotlight fades, payroll outpaces revenue, and layoffs gut capacity.

Real Example: During COVID, anti-Asian hate initiatives saw a surge in funding. Once the crisis eased, much of that funding evaporated as public attention moved to new political and social trends — democracy protection, climate, reproductive rights, Ukraine. Some causes had already met their immediate need, and groups still trying to establish themselves learned the hard way: the spike of 2021–2022 was never permanent.

The Business Parallel: It’s like a retailer betting the whole business on holiday sales. December looks great, but by March demand collapses. If you staffed and expanded as if December were the baseline, you’re in crisis by spring. What happens to trendy products and services when the spotlight shifts away without having the foresight to build for the future?

Wake-Up Solution: Same rule as grants: treat surge money as an accelerator, not your foundation. Use it to build the systems and infrastructure you’ve been putting off — tech, reserves, sustainable revenue channels. Don’t just “5x” output using the same fragile framework. Because when the trend fades, you’re left with the same weak structure — only now overextended.

Another Danger: If your nonprofit or community is small, a sudden crash after heavy expansion can damage credibility even more. Donors and partners may conclude your organization “can’t handle the mission” and shift their support elsewhere. Are you treating trend dollars as bonus fuel — or pretending they’re permanent revenue?

👉 Next post (Part 2): 3 more habits that drain nonprofits — distractions, overpromising, and neglecting reserves.

❓Which of these first 3 habits do you see most often in the nonprofit world?